Whether you’re preparing a family member to take over, looking to sell, or coaching up key employees for leadership roles, a proper plan protects your legacy and ensures long-term business continuity.

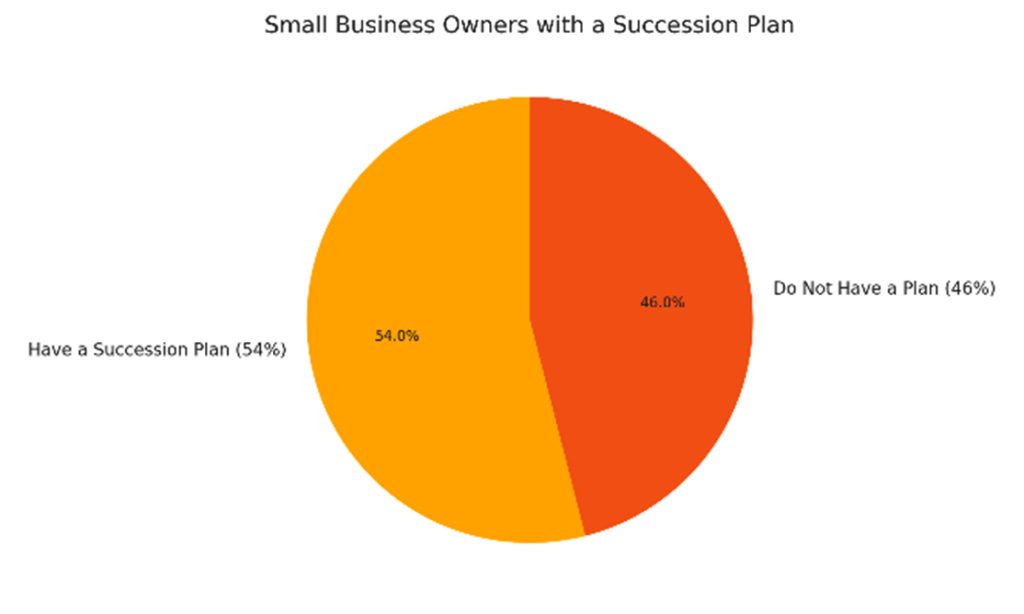

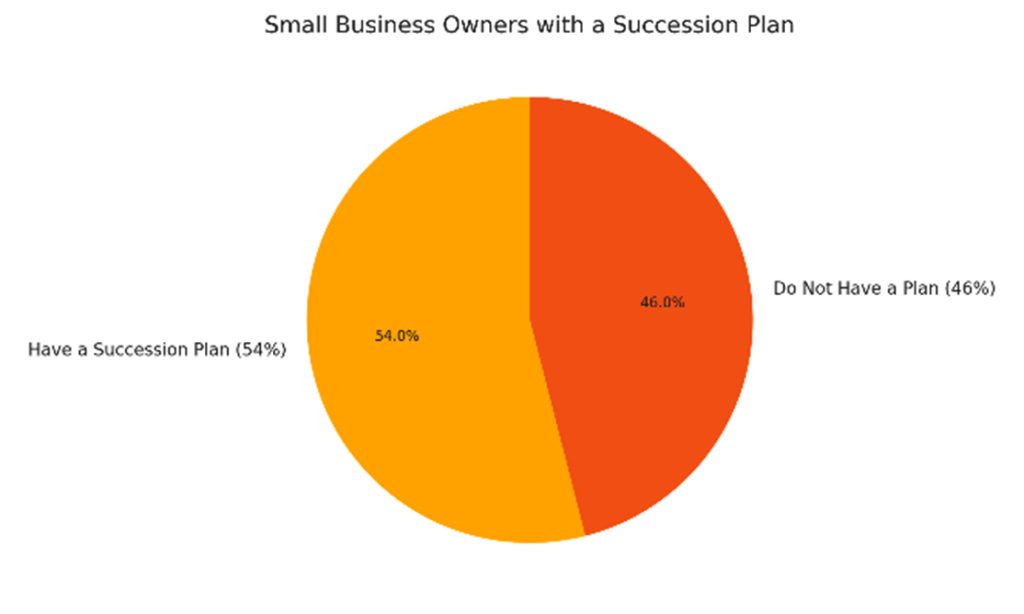

Only 54% of small-business owners have a formal succession plan (ABA Banking Journal). Yet 84% say they hope to build generational wealth or pass their business on, highlighting a major disconnect between goals and preparation.

What Is Business Succession Planning?

Think of succession planning as a roadmap for the future of your business. It’s the legal and strategic process of identifying who will own and manage the company when you step down, retire, or pass away.

A business succession plan can involve:

- Transferring ownership to a family member or trust for family members;

- Structuring a sale to key employees or outside buyers;

- Creating a buy-sell agreement among partners;

- Implementing employee stock ownership plans (ESOPs);

- Aligning business and estate planning.

Without a plan, decisions get made in a crisis. And that can include court interventions or feuding heirs. With a plan, your business can run smoothly, even in the face of unexpected changes.

“Succession planning isn't just about retirement. It's about protecting your people, your partners, and your purpose—whatever the future holds,” notes Joel D. Rosen, Esq., Managing Partner, High Swartz LLP.

Why Is Succession Planning Important?

If you’re like most owners, your business is one of your most valuable assets. But it’s also one of the most vulnerable. This becomes especially true when there’s no transition plan in place.

The cost of poor planning isn’t just financial—it’s emotional. In fact, 75% of business owners profoundly regretted selling their business within a year, according to the Exit Planning Institute’s State of Owner Readiness survey (PNC) and that regret most often stems from inadequate planning around life after transition or unrealistic expectations about value.

A solid business succession plan:

- Protects your business from the 5 D’s: death, disability, divorce, disagreement, and departure;

- Helps maintain business continuity during transitions;

- Ensures your management team knows what to do if something happens to you;

- Prevents financial and legal complications for your family or surviving partners;

- Integrates with estate planning to reduce taxes and liabilities.

Unfortunately, most small businesses lack a formal succession plan. That’s one reason why only 30% of family businesses survive into the second generation, 12% into the third, and 3% into the fourth generation or beyond (Teamshares).

What Does a Succession Plan Include?

A succession plan is more than just a document—it’s a blueprint for how your business will operate and who will lead it when you’re no longer at the helm.

The specifics depend on your industry, business structure, and personal goals, but every strong plan addresses ownership, leadership, and operational continuity. It should outline both the who and the how of the transition, while accounting for financial, legal, and tax implications.

The stakes are high, as roughly one-third of business owners have no long-term plan for their business, and 22% expect to close it (Gallup). Without a clear roadmap, years of hard work can vanish in a matter of months.

A well-structured plan often includes:

- Ownership transfer structure: who will own what, and when?

- Management succession: who will lead the business day-to-day?

- Buy-sell agreements: legal documents that guide ownership transfer in case of death or departure.

- Business valuation: so you have a method to determine the fair market value before any sale or transfer.

- Contingency planning: for emergencies or unexpected disruptions.

- Communication strategies: so key employees and family members are on the same page.

- Tax and estate integration: to protect wealth and avoid surprises.

How a Business Attorney Can Assist You

Planning isn’t just about naming a successor. It’s about creating legal, financial, and operational structures to support a smooth transfer. That’s where the right legal guidance comes in.

An experienced business succession attorney can:

- Draft and review buy-sell agreements;

- Coordinate with your estate plan;

- Help with valuation and tax strategy;

- Structure partnership or corporate governance;

- Address family dynamics or ownership disputes;

- Prepare your business for eventual sale or employee transition.

An attorney familiar with Pennsylvania’s business and estate laws can guide you through the legal considerations that often shape a succession plan.

From Pennsylvania’s Business Corporation Law and LLC statutes to inheritance tax rules and the Uniform Partnership Act, your succession plan must align with both your business structure and long-term goals. A Pennsylvania business succession attorney helps ensure compliance with these laws while reducing risk and safeguarding your legacy.

Let High Swartz Help You Plan for the Future

High Swartz has been guiding Pennsylvania business owners through complex transitions for over 100 years. Whether you're preparing for retirement, planning an internal transfer, or protecting against the unexpected, we can help you develop a succession plan that addresses your needs.

Contact our Business Law team today to start the conversation.

FAQ: Business Succession Planning

Every business is unique, and so are the questions owners have when it comes to succession planning. Our business attorneys often hear from clients who aren’t sure where to start, how much planning they need, or what the process looks like in practice.

An FAQ section can’t replace personalized legal advice, but it can help you understand the fundamentals before you meet with your attorney.

Below are some of the most common questions we hear from Pennsylvania business owners, especially near us in the suburbs of Philadelphia.

What are the 5 D's of succession planning?

They refer to five common events that disrupt business ownership: Death, Disability, Divorce, Disagreement, and Departure. A solid plan is prepared for all of them.

What are the steps in succession planning?

Typically:

- Assess your goals

- Identify potential successors

- Value the business

- Create legal documents (like a buy-sell agreement)

- Communicate and implement the plan

In Pennsylvania, these steps should also be coordinated with your estate plan and comply with state business statutes.

How do you write a simple succession plan?

Start by identifying a successor and documenting your goals. Work with legal and financial advisors to put it into writing and make it legally binding.

Why is succession planning important for small businesses?

Without a succession plan, many small businesses struggle to survive when an owner retires, becomes disabled, or passes away. Planning ahead protects employees, secures your family’s financial future, and preserves business value.

The information on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content of this website is accurate and up-to-date, laws and legal processes vary significantly based on location and individual circumstances. The content included herein should not be used as a substitute for consulting with a qualified attorney. For advice tailored to your legal matter, please contact our law offices to speak with one of our experienced local attorneys.