News

$3.25M Jury Award in Chester County Highlights Legal Options for Homeowners Facing Construction Defects

On June 5, 2025, a Chester County jury awarded $3.25 million to three families in...

Mary Cushing Doherty Honored with the Honorable Katherine Platt Award for Mentoring and Volunteerism

High Swartz LLP proudly congratulates Mary Cushing Doherty, Esq., Of Counsel, on receiving the Honorable...

Municipal Group add Paige Delia, Esq.

We are pleased to announce the addition of municipal attorney, Paige Delia, to the firm....

10 High Swartz Attorneys named to 2025 PA Super Lawyers® and Rising Stars Lists

The Pennsylvania Super Lawyers® List continues to acknowledge High Swartz Attorneys. High Swartz is pleased...

Memorial Day Picnic During the Doylestown Parade at High Swartz LLP

If you're planning to attend, kindly RSVP to Darlene at dsellers@highswartz.com or call 215-345-8888. We're...

General Practice Attorney Vincent A. Guarna Joins the Firm

High Swartz LLP is pleased to announce the addition of Vincent A. Guarna Esquire, practicing...

High Swartz LLP Ranked in Best Law Firms® Latest Edition in 14 Practice Areas in the Philadelphia Region

High Swartz LLP Earns National Recognition as a Tier 1 Law Firm in Land Use...

Mary Cushing Doherty Presents at AAML Penn Seminar Series Reviewing Uniform Parentage Act (HB 350)

On September 24, 2024, Mary Cushing Doherty presented at the AAML Penn Seminar Series today...

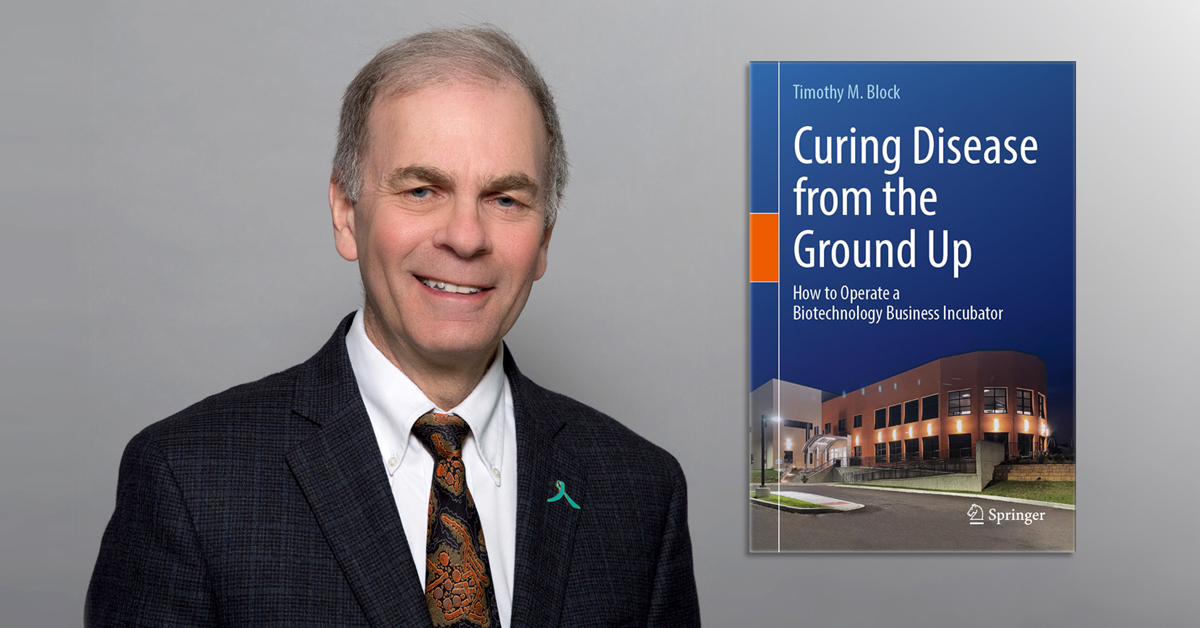

High Swartz Client Spotlight: Timothy M. Block, PhD Publishes BioTech Incubator Guidebook

Timothy M. Block, PhD, President of Hepatitis B Foundation and its Baruch S. Blumberg Institute...

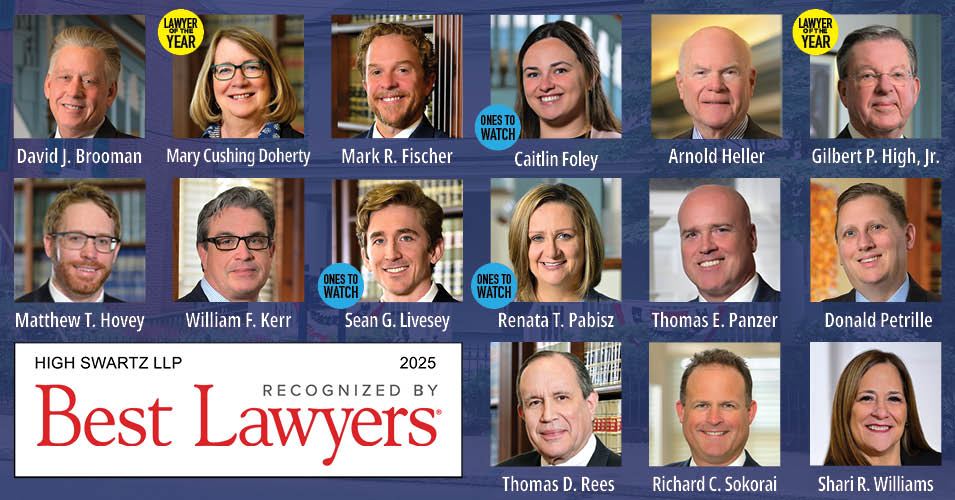

15 High Swartz LLP Lawyers Recognized by Best Lawyers in America® for 2025

The Best Lawyers in America© 2025 edition includes 12 High Swartz Attorneys and 3 in...