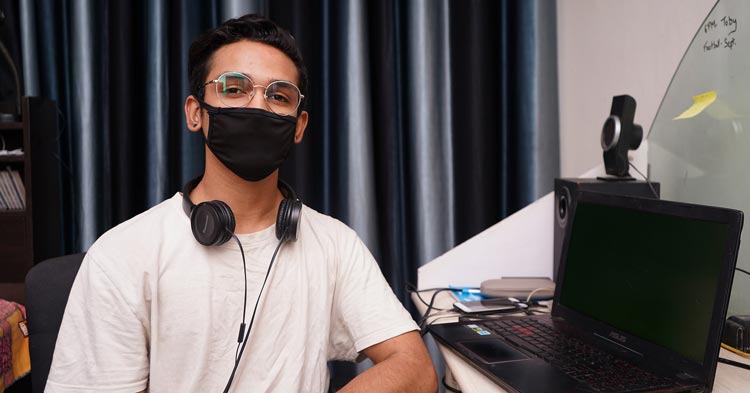

With the possibility of students returning to school during a pandemic, making sure they make the right decisions regarding their health is paramount. Talk to an estate attorney about a POA for teens.

Colleges and universities across the country are releasing their return-to-school plans in an effort to address the uncertainty for students and staff. Will in-class teaching be available? Will every student be able to attend? What about safety practices and social distancing? All of these questions will need to be addressed before any decision can be made. And with the unpredictability of the coronavirus, those plans could change in an instant. That's why you should talk with an estate planning attorney about a POA for teens.

Whether your child is a freshman or returning senior, the most important question you’ll ask yourself is whether it will be a safe place for them. What will happen if my child gets sick or hurt? For this reason, more importantly, it is also time for them to consider a Medical Power of Attorney and Durable Power of Attorney for your teens.

Why do I need a medical POA for my college-bound teen?

Doctors, hospitals and even the college they are attending are limited in what information can be shared with parents or other adults. Without a Medical Power of Attorney, a parent, even one paying their tuition, covering their health insurance, and claiming them as a dependent on their tax return, could be helpless to aid their adult child if an emergency arises. A Power of Attorney for medical and financial matters allows your college-bound child to appoint someone to handle these matters for them if they are unable or unavailable to handle them themselves.

You cannot rely on documents executed through the school since they are limited to accessing school records and in limited circumstances, to medical treatment at the school only. To assist your student or any young adult, a POA for teens, which includes access to medical records and treatment must be executed. It is best to have these documents drafted by an estate planning attorney and not rely on forms downloaded from the internet as they may not meet all of the necessary legal requirements.

Proper planning is essential

Proper planning can allow your young adult to appoint the person or persons they trust to handle financial and medical matters for them. If they have a serious illness or accident, having these documents in place can save the family time and significant costs by avoiding the immediate need to seek a court-appointed guardian. If they are traveling abroad and need assistance with matters at home, a Durable POA for your teen allows their agent to handle banking transactions, sign tax returns, and many other types of matters for them.

A young adult, or any adult for that matter, should take the time to be sure these documents are in place before they become necessary. Please call one of our estate planning attorneys for more information.

If you have any questions about a Medical Power of Attorney or Durable Power of Attorney, please contact the estate planning attorneys at High Swartz at 610-275-0700 or via our contact form.

The information above is general: we recommend that you consult an attorney regarding your specific circumstances. The content of this information is not meant to be considered as legal advice or a substitute for legal representation.