When legal conflicts arise in Orphans’ Court, families face more than legal costs—they risk long-term damage to personal relationships.

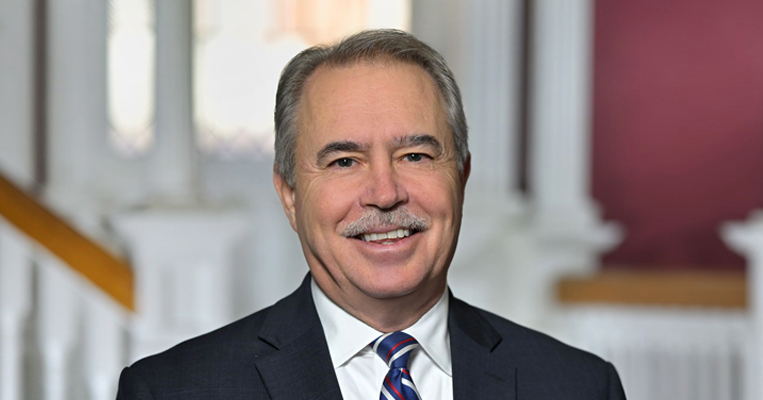

On May 6, 2025, attorney Donald Petrille, Jr. will speak at the 7th Annual Business Law Institute hosted by the Bucks County Bar Association. His CLE presentation—“Mediation for Orphans’ Court and the Register of Wills”—addresses how Pennsylvania families and legal professionals can use mediation to resolve complex estate disputes with dignity, efficiency, and clarity.

This article outlines the core ideas of that session to inform families, attorneys, fiduciaries, and court-connected professionals throughout Southeastern Pennsylvania.

What Is Mediation?

Mediation uses a neutral third party—a mediator—to help two or more individuals in conflict reach a mutual agreement. Unlike arbitration or trial, mediation allows both parties to retain control of the outcome.

In Pennsylvania, mediation begins as soon as a party contacts a mediator or mediation program (42 Pa. C.S.A. § 5949). It remains voluntary and confidential throughout.

Who Benefits from Mediation in Orphans’ Court?

Mediation applies to a broad range of estate-related disputes in Pennsylvania, especially those before the Orphans’ Court or Register of Wills:

- Heirs and beneficiaries disputing asset distributions

- Executors and trustees managing estate or trust administration

- Guardians or family members concerned with powers of attorney or incapacity claims

- Fiduciaries or legal counsel handling contested accountings

- Families in emotional conflict—sometimes referred to as “family divorce” cases

Why Choose Mediation Over Litigation?

Litigation can stretch over months—or years—while draining financial and emotional resources. Mediation offers a structured but flexible alternative.

| Litigation | Mediation |

|---|---|

| Court dictates schedule | Parties set the schedule |

| Bound by procedural rules | Parties adapt process to needs |

| Formal and public | Informal and confidential |

| Judge decides the outcome | Parties decide the outcome |

| Often zero-sum | Allows creative, win-win solutions |

How Mediation Works: The Process Step-by-Step

High Swartz LLP encourages clients to understand the mediation process before committing:

Before Mediation

- Parties sign a mediation agreement

- The mediator schedules sessions

- Parties submit confidential background memoranda

- Legal counsel prepares clients for discussion

During Mediation

- Mediator begins with a joint session

- Each party shares their goals and issues

- Mediator may separate parties for confidential caucuses

- The mediator identifies the Zone of Possible Agreement (ZOPA)

- If progress continues, the session ends with a written settlement memorandum

Mediators may ask each party to consider:

- BATNA: Best Alternative to a Negotiated Agreement

- WATNA: Worst Alternative to a Negotiated Agreement

What Makes Mediation Effective?

For mediation to succeed, both parties must show:

- Willingness to participate

- Openness to listening

- Flexibility in identifying solutions

- A clear understanding that mediation differs from a settlement conference

If either party seeks to dominate, the process will likely stall. When parties remain committed to the dialogue, mediation often produces thoughtful, lasting outcomes.

The Attorney’s Role in Mediation

Attorneys who represent clients in mediation act as strategic advisors and facilitators, not adversaries. Attorneys should:

- Help clients clarify goals and concerns

- Provide legal framing to support realistic negotiation

- Identify legal limits and risks to guide productive discussion

- Support—not overshadow—client decision-making

What Types of Mediation Work Best?

Don Petrille’s presentation highlights three primary models:

- Evaluative Mediation: The mediator assesses strengths and weaknesses and may suggest solutions. Attorneys favor this model when parties seek risk analysis.

- Facilitative Mediation: The mediator encourages discussion and helps parties express needs, emotions, and interests. This model supports dignity and openness.

- Transformative Mediation: The mediator helps parties shift how they relate to one another—ideal for emotionally charged family matters.

Each model serves different scenarios. In many cases, the mediator will draw on aspects of all three.

Join Us on May 6 to Learn More

On Tuesday, May 6, 2025, attorney Don Petrille will present “Mediation for Orphans’ Court and Register of Wills” during the Bucks County Bar Association’s 7th Annual Business Law Institute.

🕣 Time: 8:30 AM – 4:30 PM

📍 Location: Bucks County Bar Association

🔗 Register Here: https://bucksbar.intouchondemand.com/barlanding.aspx?pg=ER&eventid=36903&cart=1

Contact High Swartz LLP

Doylestown Office

116 E. Court Street, Doylestown, PA 18901

📞 (215) 345-8888

✉️ dpetrille@highswartz.com